2017 Miami Real Estate Year-End Report

February,15 2018Miami recorded the fifth-most annual single-family home sales in county history in 2017 as total dollar volume and median prices rose at year-end and in 4Q 2017, according to a new report by the MIAMI Association of REALTORS® (MIAMI) and the Multiple Listing Service (MLS) system.

Miami-Dade County registered 12,775 single-family home sales in 2017, down 3.0 percent from the year before. Lack of supply in certain price ranges and neighborhoods impacted sales. Inventory and months' supply of single-family homes continues to drop, showing a strong demand and insufficient supply.

Only 2015 (13,898 single-family home transactions), 2014 (13,521), 2016 (13,164) and 2013 (12,912) had more annual Miami single-family home sales. MIAMI and the MLS have been tracking county sales since 1994.

"Miami real estate is thriving as evidenced by the historic number of annual single-family home transactions the last five years," said Miami broker George C. Jalil, the 2018 MIAMI Chairman of the Board. "Miami posted a strong 2017 despite having some closings and inspections delayed in September because of Hurricane Irma. An increasing population, growing jobs market and pent-up demand is benefiting Miami real estate."

Here is the full report.

Existing Condominiums Post Eighth-Best Sales Year

- Miami existing condominiums posted the eighth-best sales year in history despite competing with Miami's multi-billion dollar new condo construction market. A total of 13,111 Miami existing condominiums were sold in 2017, down 3.6 percent from 13,604 in 2016.

- The lack of access to mortgage loans continues to impact existing condominium sales. Of the 9,307 condominium buildings in Miami-Dade and Broward Counties, only 12 are approved for Federal Housing Administration loans, down from 29 last year, according to statistics from the Florida Department of Business and Professional Regulation and FHA.

Luxury Miami Single-Family Homes Rise in 2017

- Luxury ($1 million-and-up) Miami single-family homes registered a 2.2 percent sales increase in 2017, rising to 877. Luxury condo sales decreased 2.2 percent to 698 transactions in 2017.

- There is strong pent-up demand for Miami luxury single-family homes. Luxury sellers are becoming more realistic with their asking prices. Federal tax reform is also starting to have an impact as more Northeastern buyers are opting to purchase in Miami to escape the higher taxes they could face in states like New York and New Jersey.

- Federal tax reform, which was signed into law Dec. 22, sets a deductions cap for income, sales and property taxes at $10,000. The new cap could lead more residents of states with high property values and state income tax to purchase properties in states such as Florida, which has no state income tax and a pro-business tax structure.

$11.2 Billion in Miami Home Sales in 2017

- Sales volume for all Miami properties in 2017 increased 2.8 percent to $11.2 billion, up from $10.9 billion in 2016.

- Miami existing single-family homes finished 2017 with a median sales price of $326,000, up 10.5 percent from $295,000 the previous year. The Miami median price for existing condominiums in 2017 was $225,000, an increase of 5.9 percent from $212,500 in 2016.

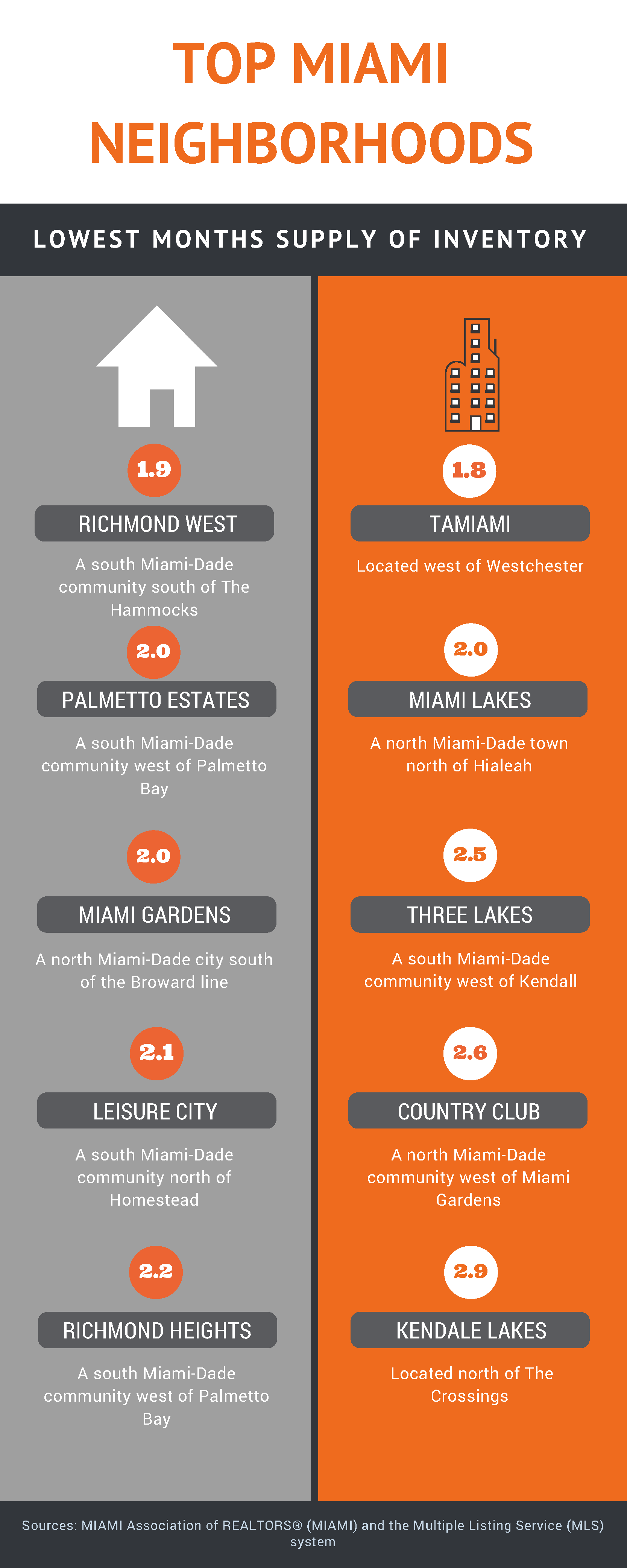

Hottest Miami-Dade Neighborhoods at Year-End 2017

- Months' supply of inventory, which is an important indicator of consumer demand and market performance, reflects limited supply in many neighborhoods and price ranges. As a result, lack of supply is also impacting property sales, particularly for single-family homes.

Top Miami neighborhoods with the lowest months of supply of inventory with significant closed sales activity at year-end 2017:

Single-Family Homes

1. Richmond West, a south Miami-Dade community south of The Hammocks, had 1.9 months supply

2. Palmetto Estates, a south Miami-Dade community west of Palmetto Bay, had 2.0 months supply

3. Miami Gardens, a north Miami-Dade city south of the Broward line, had 2.0 months supply

4. Leisure City, a south Miami-Dade community north of Homestead, had 2.1 months supply

5. Richmond Heights, a south Miami-Dade community west of Palmetto Bay, had 2.2 months supply

Condominiums

1. Tamiami, located west of Westchester, had 1.8 months supply

2. Miami Lakes, a north Miami-Dade town north of Hialeah, had 2.0 months supply

3. Three Lakes, a south Miami-Dade community west of Kendall, had 2.5 months supply

4. Country Club, a north Miami-Dade community west of Miami Gardens, had 2.6 months supply

5. Kendale Lakes, located north of The Crossings, had 2.9 months supply

Miami Real Estate Selling Close to List Price

- The average percent of original list price received for single-family homes in 2017 was 95.3 percent in 2017, a decrease of 0.3 percent from a year earlier. The median number of days to contract for Miami single-family homes fell 4 percent to 48 days in 2017 from 50 days in 2016.

- The median number of days to contract for condominiums sold in 2017 was 76 days, a 7.0 percent increase from 71 days in 2016. The average percent of original list price received was 93.6 percent, a 0.3 percent year-over-year decrease.

State Year-End Statistics

- Statewide closed sales of existing single-family homes totaled 271,868 in 2017, up 1.2 percent compared to the 2016 figure, according to Florida Realtors. The statewide median sales price for single-family existing homes in 2017 was $237,500, up 8 percent from the previous year

- Statewide closed sales of townhouse-condos totaled 111,088 units sold statewide in 2017, up 2.9 percent from 2016. The statewide median price for condominiums in 2017 was $172,500, up 7.8 percent over the previous year.

- The interest rate for a 30-year fixed-rate mortgage averaged 3.99 percent for 2017, up significantly from the previous year's average of 3.65 percent, according to Freddie Mac.

Miami's Cash Buyers Represent Double the National Figure

- In 2017, cash deals represented 40.4 percent of Miami's total closed sales, which is a decrease from 45.7 percent in 2016. Just 20 percent of all U.S. housing sales are made in cash, according to NAR. Miami's high percentage of cash sales reflects South Florida's ability to attract a diverse number of international home buyers, who tend to purchase properties in all cash.

- Condominiums comprise a large portion of Miami's cash purchases as 55.3 percent of condo closings were made in cash in 2017 compared to 25.1 percent of single-family home sales.

Distressed Property Transactions Continue to Decline in Miami

- About 10.4 percent of all closed residential sales in Miami were distressed in 2017, including REO (bank-owned properties) and short sales, compared to 17.2 percent in 2015.

- Short sales and REOs accounted for 2.5 and 7.9 percent, respectively, of total Miami sales in 2017. Short sale transactions dropped 30.6 percent year-over-year while REOs decreased 44.4 percent. A decline in short sales points to more homeowners with increased equity, which should result in increased market activity.

Seller's Market for Miami Single-Family Homes, Buyer's Market for Condos

- Inventory of single-family homes decreased 4 percent in 2017 from 6,218 active listings in 2016 to 5,969 in 2017. Condominium inventory increased 3.8 percent to 14,984 in 2017 from 14,436 listings in 2016. Despite a condo countywide inventory increase, there are inventory shortages in certain price ranges and market segments.

- At the end of 2017, inventory for Miami single-family homes stood at a 5.6-month supply, a 1.8 percent decrease from 5.7 months in the previous year. Inventory for Miami existing condominiums at the end of 2017 stood at 13.7 months, a 7.9 percent increase from 12.7 months in 2016. A balanced market between buyers and sellers offers between six and nine months supply of inventory.

- Total active listings at the end of 2016 increased 1.4 percent year-over-year, from 20,654 to 20,953. Active listings remain about 60 percent below 2008 levels when sales bottomed.

- New listings of Miami single-family homes at year-end 2017 decreased 4.6 percent from 20,745 to 19,790. New listings of condominiums decreased 2.6 percent, from 28,090 to 27,354.

4Q 2017: Miami Condo Sales Rise

- Miami closed sales of existing single-family homes totaled 3,005 in the fourth quarter of 2017, down 2.9 percent compared to the previous year. Miami existing condo sales totaled 3,117 in 4Q 2017, up 2.6 percent year-over-year.

- Statewide closed sales of existing single-family homes totaled 63,436 in the fourth quarter of 2017, up 2 percent compared to the year-ago figure. Statewide existing condo sales totaled 25,544 units sold statewide in 4Q 2017, up 4.7 percent compared to the same period a year earlier.

- Nationally, total existing-home sales increased 4.3 percent to a seasonally adjusted annual rate of 5.62 million in the fourth quarter from 5.39 million in the third quarter, and are 1.3 percent higher than the 5.55 million pace during the fourth quarter of 2016.

- Median sale prices for Miami single-family homes increased 8.1 percent, from $308,000 to $332,925, in 4Q 2017. Condo median prices increased 8.2 percent from $212,500 to $230,000.

- Median sale prices for statewide single-family homes was $240,000, up 7.2 percent from 4Q 2016. Statewide condo median prices in 4Q 2017 was $175,000, up 6.6 percent over the previous year.

- The national median existing single-family home price in the fourth quarter was $247,800, which is up 5.3 percent from the fourth quarter of 2016 ($235,400). The median price during last year's third quarter climbed 5.6 percent from the third quarter of 2016.

- New listings of Miami single-family homes for sale in 4Q 2017 increased 6.1 percent compared to the same quarter the previous year, from 4,298 to 4,561. New listings for existing condos in 4Q 2017 increased 7.1 percent from 6,109 to 6,543.

Note: Statistics in this news release may vary depending on reporting dates. MIAMI reports exact statistics directly from its MLS system

Recent Posts

In the Cervera Newsroom, our mission is clear: to inform, intrigue, and inspire Miami real estate professionals and consumers.

-

Read more

Miami Real Estate Headlines — Jan. 2, 2023

Miami ranks most diverse city in the world for 2022; foreign homebuyer sales surge 34%; and ...

-

Read more

Miami Real Estate Headlines — Dec. 12, 2022

Miami ranks third most popular city for US relocations; the 2023 regional South Florida real ...

-

Read more

Miami Real Estate Headlines — Nov. 13, 2022

Citadel billionaire founder Ken Griffin says it wasn’t low taxes that led him to move his ...

-

Read more

Miami Real Estate Headlines — Nov. 6, 2022

Grammy Award-winning recording artist Future makes his presence known in Miami ...